Car insurance prices remain historically high, stretching household budgets even as the pace of increases shows early signs of cooling. Now, tariffs threaten to undo that fragile reprieve — fueling anxiety that costs could climb again. From raising deductibles and cutting back coverage to accelerating or delaying car purchases, consumers are already going to great lengths to hold onto car ownership. Jerry’s latest survey captures a snapshot of this moment: widespread anxiety, shifting buying behavior, and intensifying pressure on what has long been a foundational — but increasingly unaffordable — part of American life.

Key findings:

Insurance affordability is in crisis

- 75% of respondents say car insurance is already unaffordable.

- Monthly premiums have increased by 60% since 2020, according to the Consumer Price Index.

Cost-cutting behavior is rising

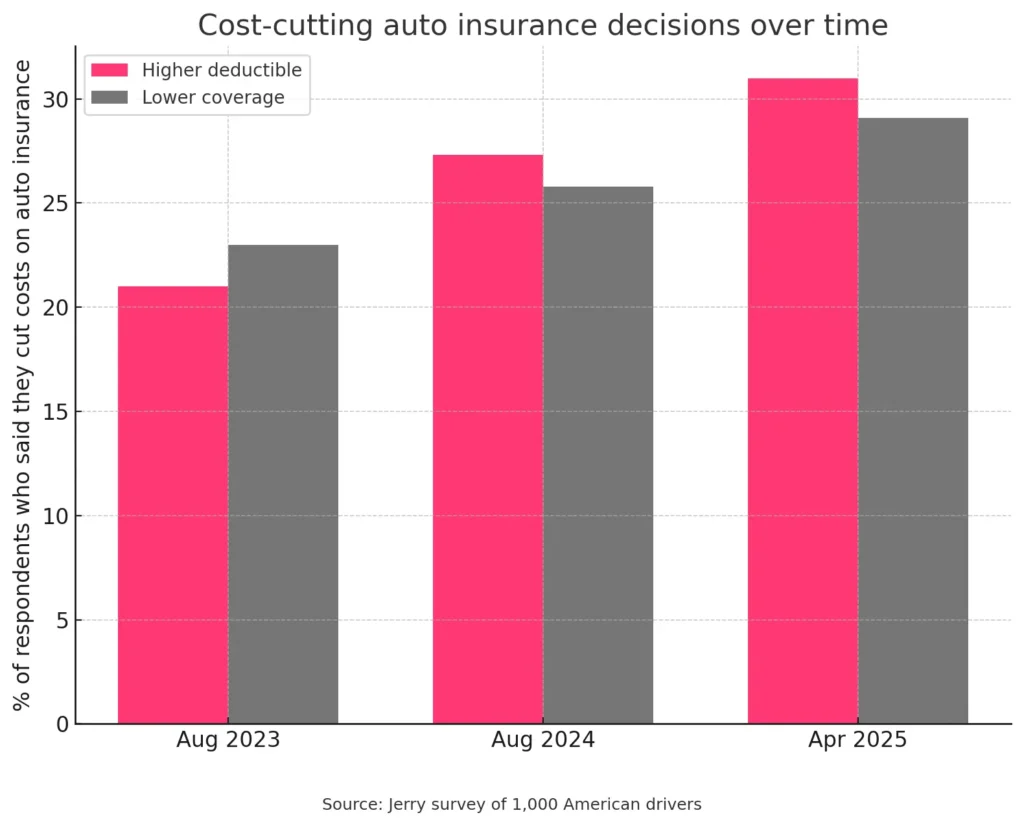

- Drivers that chose a higher deductible to lower monthly car insurance payments rose from 21% in August 2023 to 31% in April 2025.

- The percent of drivers who have lowered their level of insurance coverage to be able to afford it rose from 23% to 29.1% in the same period.

- 85% of drivers said they cut spending on entertainment, dining, vacations or groceries in response to rising car insurance costs in 2025.

Tariffs are expected to hit wallets further

- 64% of drivers said they believed tariffs will raise car insurance prices.

Tariffs are accelerating and distorting car-buying plans

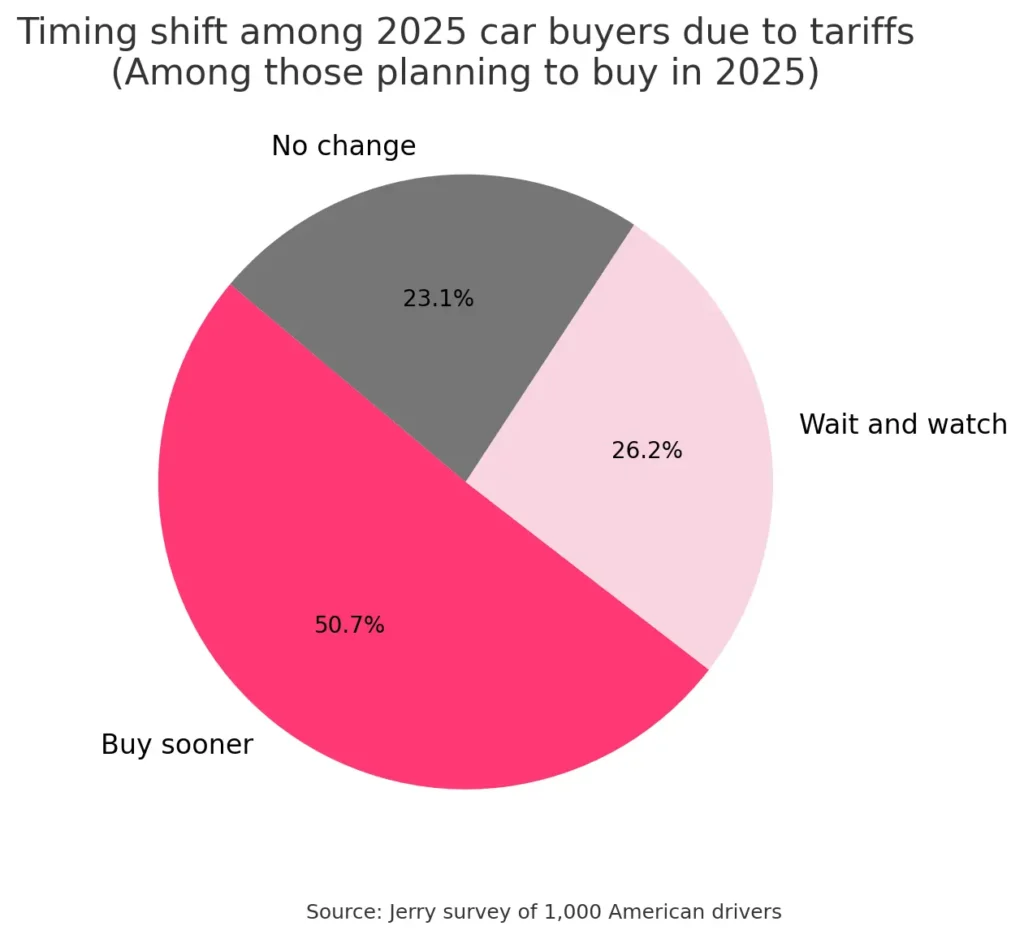

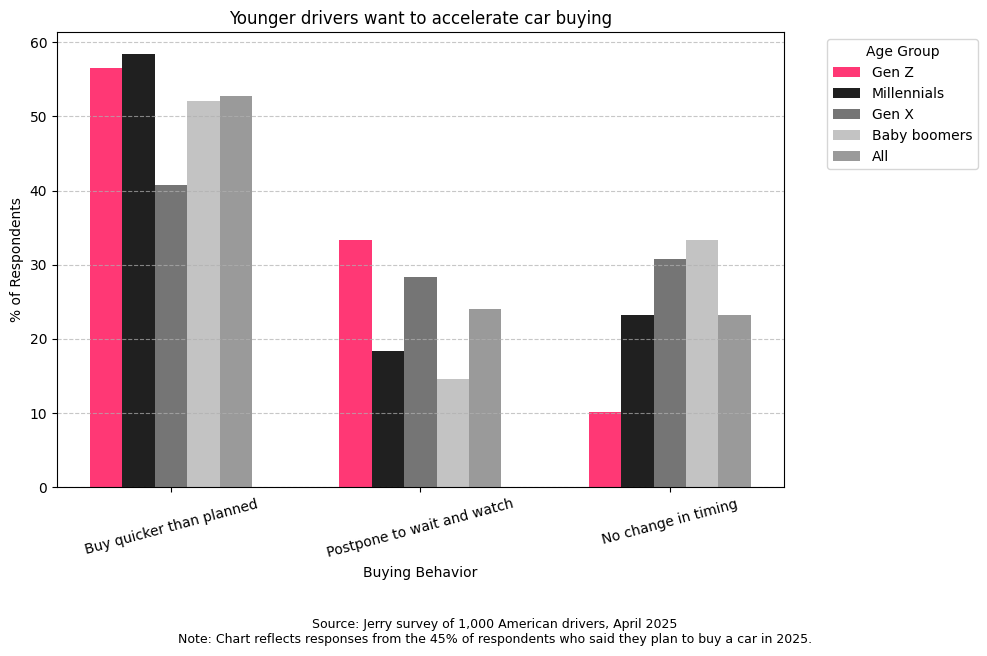

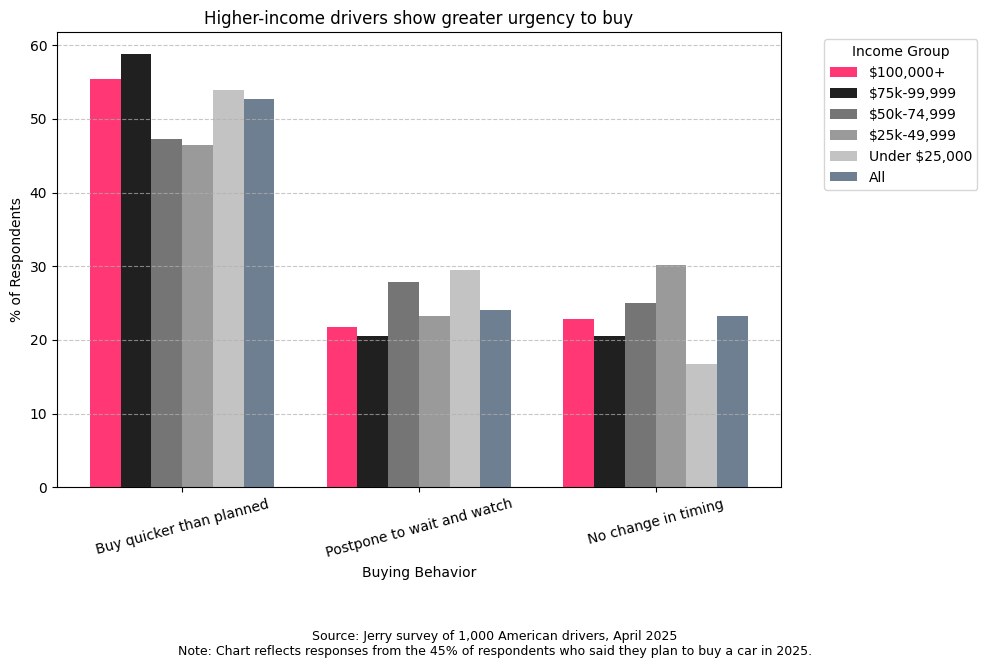

- 45% said they plan to buy or lease a car in 2025. Among them, 51% say they’ll buy sooner because of tariffs and 25% say they’ll delay to wait out the policy changes. Younger and higher-income drivers accelerate car-buying plans.

Nearly two-thirds say tariffs will raise the prices of car insurance in the future

Car insurance premiums have nearly doubled over the past five years, taking up a much larger share of monthly household expenses. While the 6.2% increase in April 2025 marks the slowest year-over-year rise in nearly three years, insurance remains far more expensive than pre-pandemic levels and continues to strain family budgets.

Three out of four drivers believe car insurance is becoming unaffordable. Many are taking on greater financial risk to cut monthly costs: 31% of respondents said they opted for a higher deductible during Jerry’s April survey, yet over a third of them said they couldn’t afford to pay that deductible if needed today.

Another 30% bought less coverage, and nearly 75% of those drivers acknowledged they now carry less protection than they believe they need.

These cost-cutting measures have surged over time — 21% chose higher deductibles in August 2023, compared to 31% today; and those who have reduced their coverage rose from 23% to 29.1% in the same period.

Two-thirds of those surveyed said that tariffs will increase car insurance prices in the future.

Lower-income and younger drivers are at the forefront of cost-cutting decisions, like raising deductibles and reducing coverage. These groups are also the most likely to say insurance is unaffordable — clear signs they’re bearing the brunt of rising car ownership costs.

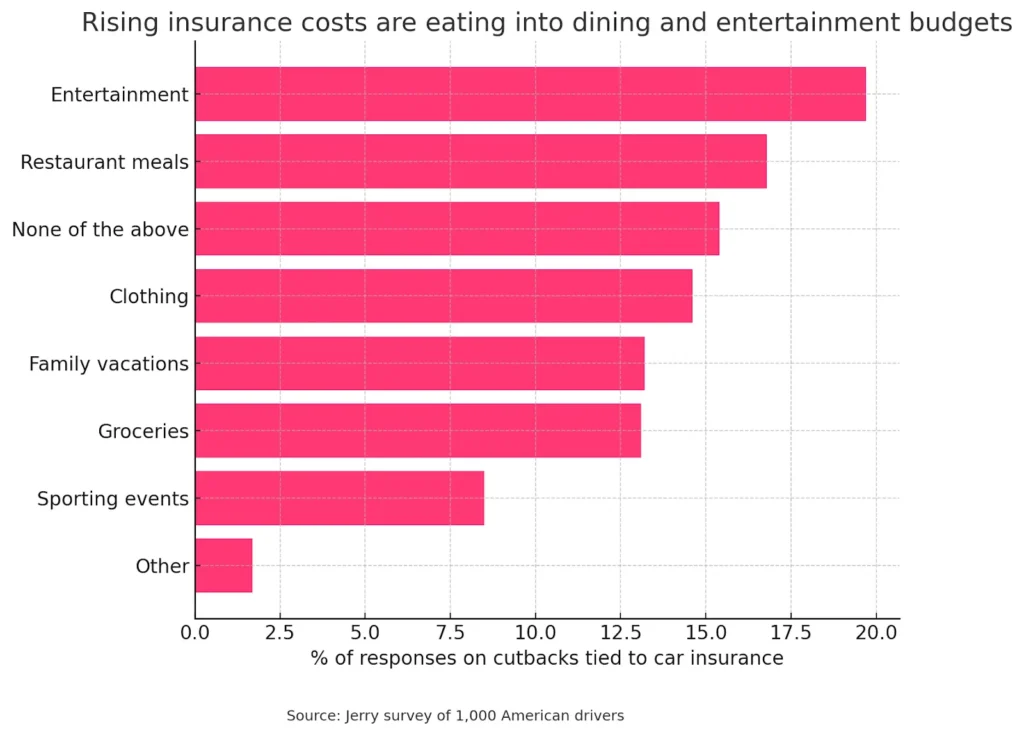

As car insurance prices rise, consumers said they’re cutting back on expenses like entertainment and dining out

85% said they’ve been cutting back on entertainment, eating out, family vacations and other costs as car insurance costs rise.

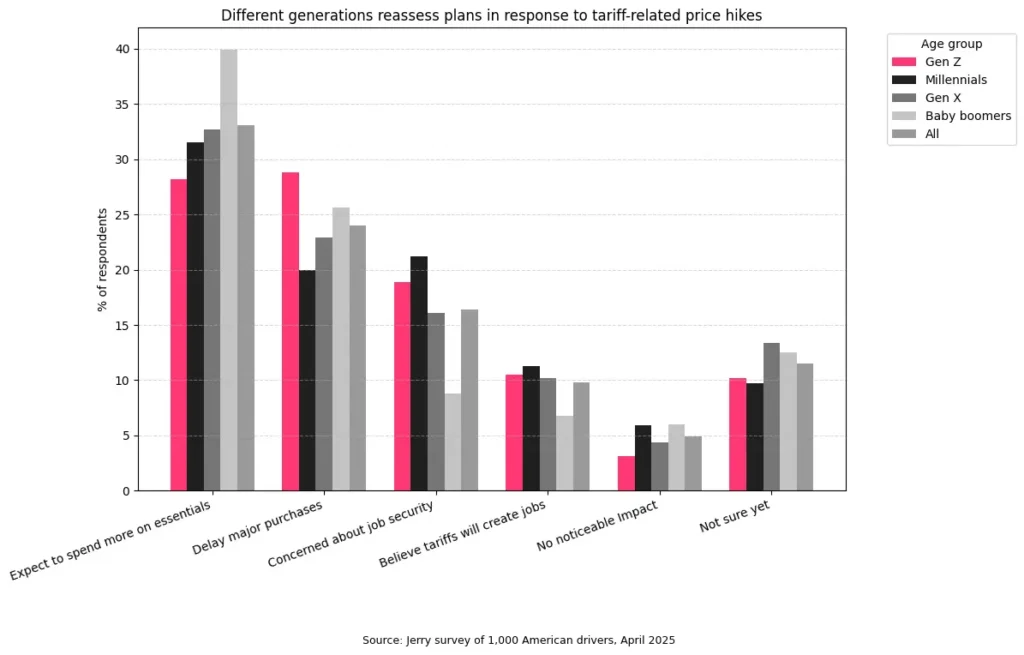

A majority (57%) said that tariffs will also impact their daily budgets, forcing them to spend more on groceries and delay major purchases. Gen Z drivers — 28.8% of whom say they may delay major purchases like cars or appliances — are rethinking their spending amid tariff concerns, more than any other generation. Meanwhile, 39.9% of baby boomers say they expect to spend more on essentials like groceries and gas because of the tariffs.

Tariffs jolt buyers into action: Some race to buy, others back out

Drivers still show a strong appetite for buying new cars, but respondents say tariffs will influence the timing of their purchases and the brand they may choose to buy, according to Jerry’s most recent survey in April.

Younger and higher-income drivers to shift car-buying plans

Of the 45% who said they’d like to buy a car in 2025, more young drivers and high-income earners say they’d like to lock in prices before tariff-related hikes work their way into the system and raise car prices.

Last year’s car buyers dodged tariffs

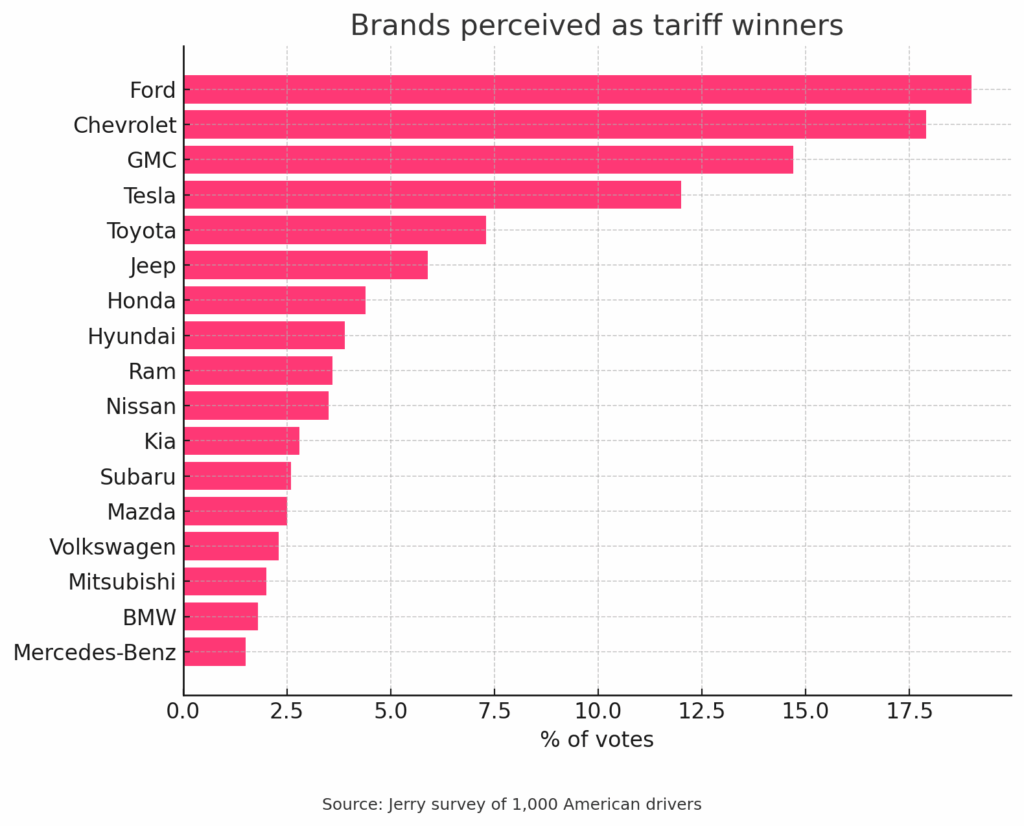

Among those who bought a car in the last 12 months, 43% said they were glad that they bought before car prices increased. More than a quarter said they were glad that they purchased American brands such as Ford, Tesla and Chevrolet — automakers that consumers believe will be among the least affected by tariffs.

Ford, Chevrolet, GMC and Tesla seen as tariff winners

More than half of all “winner” votes from respondents went to just four brands — Ford, Chevrolet, GMC, and Tesla — indicating that these American automakers are most widely perceived to benefit from the tariffs.

A Jerry analysis of 500 car models confirms some of what the users think: 24 car models — including all current Teslas and several trims from Jeep, Ram and Volkswagen — face zero tariff impact under the new rules. Another 49 models, including the Ford Maverick, Nissan Versa and Kia EV6 are estimated to incur surcharges no higher than 5%. Our car tariff price estimator tool shows how much tariffs could impact different makes and models.

Automakers that assemble vehicles in North America and source parts locally are better positioned to withstand tariffs, regardless of whether the brand is technically American or foreign.

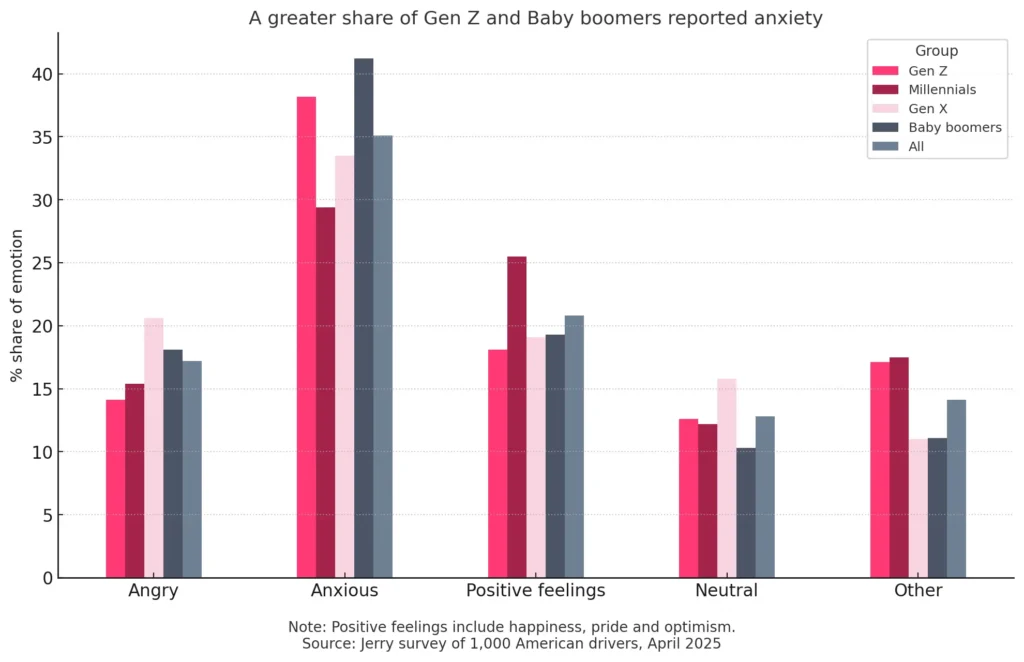

Tariffs fuel consumer anxiety

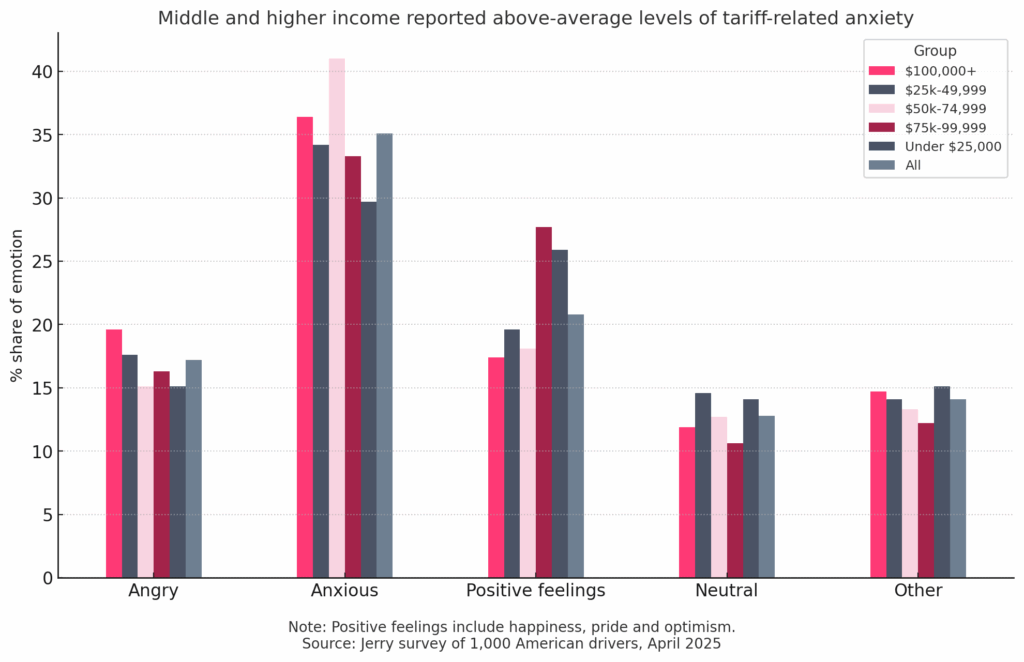

A majority of American drivers feel anxious (34%) about the economy or angry (17%) about the new and proposed tariffs. Women, young adults and middle and higher income drivers feel more angry and anxious. Gen Z drivers and middle- and higher-income brackets said tariffs have caused them to feel more angry and anxious.

Methodology

Jerry’s April 2025 consumer sentiment study is based on data from a nationally representative survey of 1,000 people conducted in April 2025 using a platform and audience from Pollfish. All respondents own or lease a vehicle, drive at least once per week, and are responsible for paying for car insurance for themselves and/or their family. Respondents were blended for age, gender, and region using census weights. More information about Pollfish and its audiences can be found on its website. Inflation figures are based on data from the Bureau of Labor Statistics.

Sinduja Rangarajan is an award-winning journalist whose reporting has informed public understanding and driven meaningful change. Her most recent role was as a senior data reporter at Bloomberg News, where her work received multiple honors, including recognition as a Pulitzer Prize finalist for her contributions to the “water grab” series in 2024.

Before joining Bloomberg, she served as a data and interactives editor at Mother Jones and as a data reporter at Reveal from The Center for Investigative Reporting. She holds two master’s degrees in communications and journalism, as well as a bachelor’s degree in computer science. She lives in the San Francisco Bay Area with her partner and two children.

Lacie Glover is a Lead Writer and Editor with sixteen years’ experience in the insurance category. Prior to Jerry, she spent more than a decade on NerdWallet’s content team writing, editing and then overseeing the auto insurance category, as well as dabbling in other insurance and automotive topics. Prior to her career in the online personal finance content space, Lacie spent time in the hard sciences, in clinical research and chemistry labs. She has a bachelor’s degree from Colorado State University.

Annie is a writer and editor at Jerry with more than a decade of experience writing and editing digital content. Before joining Jerry, she was an assistant assigning editor at NerdWallet. Her past work has appeared in the Associated Press, USA Today and The Washington Post. Her work has been cited by Northwestern University and Harvard Kennedy School. Annie served as a spokesperson for NerdWallet during her time at NerdWallet and has been featured in New York Magazine, MarketWatch and on local television and radio stations.

Previously, she worked at USAA and newspapers in Minnesota, North Dakota, California and Texas. She has a bachelor’s degree in journalism from the University of Minnesota.