Over the past few weeks, the U.S. has finalized tariff agreements with scores of countries. Most consequential for auto prices are the deals with Japan, South Korea and the European Union, which cap tariffs on vehicles and parts at 15%—down from the proposed 25%. Even with the lower rate, car prices can still rise by thousands, depending on the model and how much of it is sourced outside North America.

Key findings:

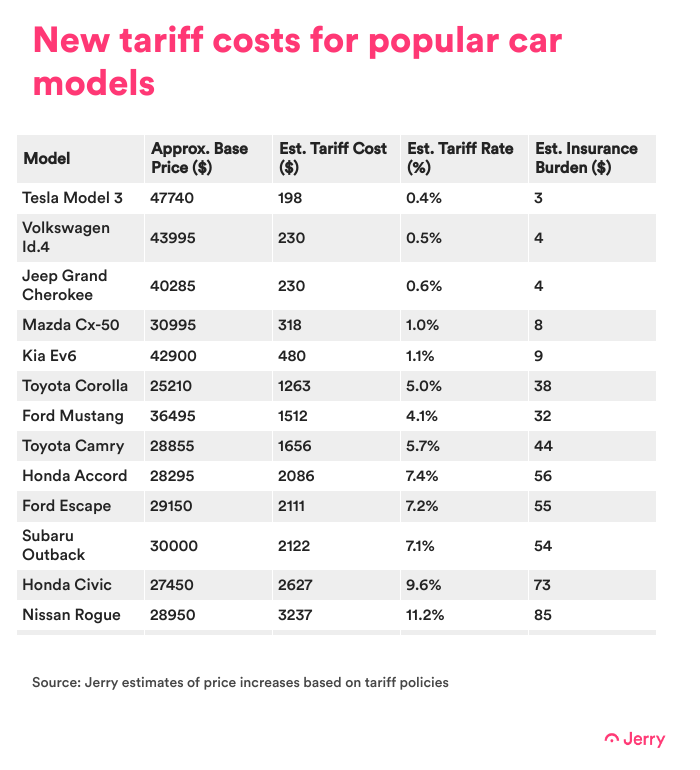

- Non-luxury cars now face an average tariff burden of $4,113 under the updated 15% import policy, though many budget-friendly models such as the Mazda CX50, Chevy Express and Kia EV6 escape with less than $1,000 in added costs.

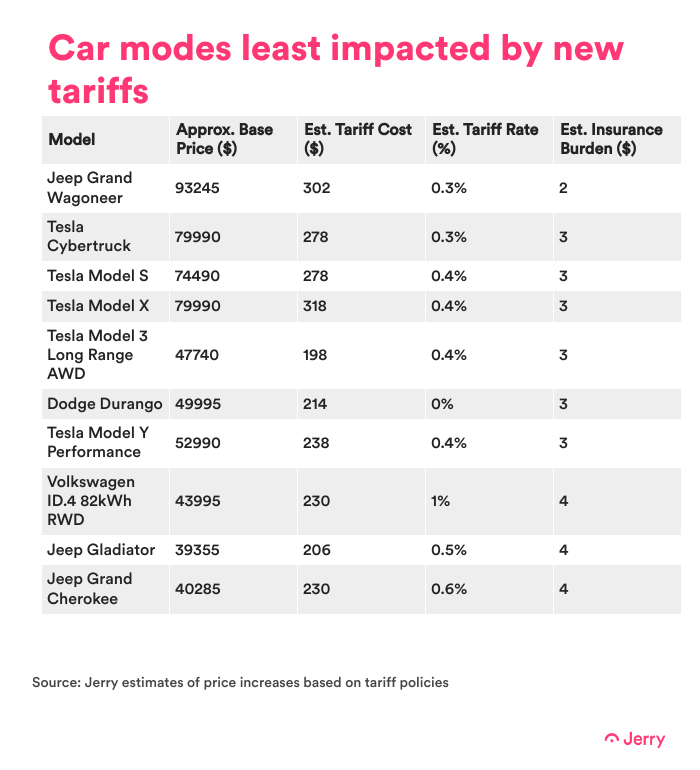

- Models with high U.S. content, such as the Tesla Model 3, Jeep Grand Wagoneer and RAM 1500, carry minimal tariff burdens, sometimes as low as $200 to $500, offering rare relief amid widespread price hikes.

- Luxury cars face an average estimated tariff hit of $17,100, driven largely by higher base prices and limited North American content. Some high-end trims of Porsche, Mercedes-Benz and BMW will still add more than $30,000 in tariffs alone.

- New trade deals have reduced average tariff costs for Japanese and Korean car brands. Some models from Kia, Mazda and Subaru now typically incur tariffs ranging from $4,000 to $5,000—nearly 5% less than under previous policies. These savings reflect the impact of the new 15% tariff cap for Japan, Korea, and the EU—down from the prior 25% baseline.

See how prices could increase for more than 500 car models on this interactive tool developed by Jerry.

How tariffs may impact car prices

See the effect on specific models

Winners and Losers

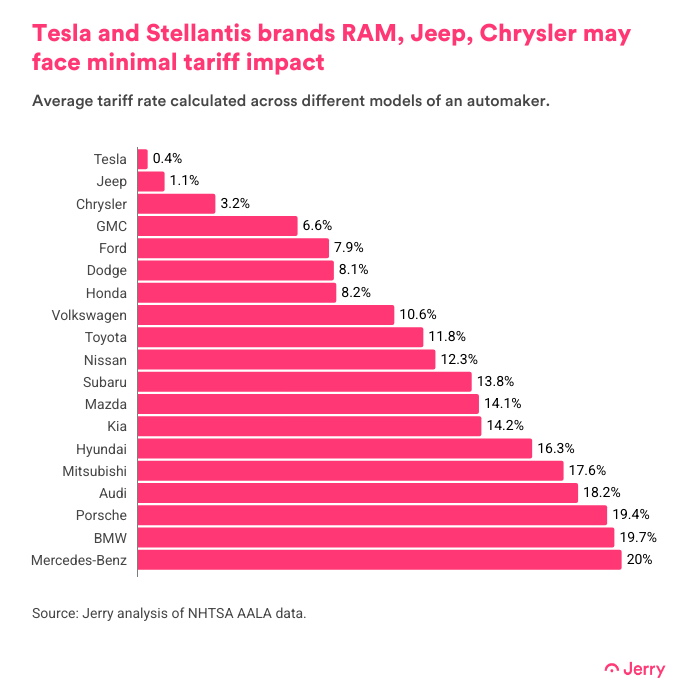

The impact of the tariffs isn’t evenly distributed: Tesla, Jeep and Chrysler models are largely insulated, while luxury brands like Porsche, BMW and Mercedes-Benz still face steep price hikes despite slight relief under the new rules. European luxury models and cars manufactured in Japan and Korea benefit modestly from the reduced tariff caps, but can costs may still rise depending on where a particular model is built.

That’s not just about where the car is assembled — metal tariffs on steel and aluminum are also quietly inflating prices. For car buyers, this means researching and carefully evaluating the impact of tariffs before hitting the dealership.

Read: Drivers are reacting to tariffs by accelerating buying plans

What consumers should consider when buying a new car

Luxury shoppers: Imported vehicles with fewer North American components — particularly from Europe — may face price hikes of 15% or more.

Budget-conscious buyers: Consider compact sedans or models assembled in North America. These tend to be less exposed to the new tariffs, helping you avoid thousands in added costs.

Insurance impact: While premiums aren’t adjusting overnight, higher vehicle prices could lead to increased insurance costs in the coming months. Some buyers may see annual premiums rise by $150 to $500, depending on the model and final sticker price, according to Jerry’s analysis.

Car tariffs price estimator methodology

Jerry’s data journalist and editorial team analyzed over 500 vehicle models using the 2025 National Highway Traffic Safety Administration American Automobile Labeling Act (AALA) data to estimate the impact of trade tariffs on vehicle prices.1

We calculated the share of each vehicle’s parts sourced from the U.S., Mexico and Canada to assess compliance with the United States-Mexico-Canada Agreement (USMCA).23

Tariffs were applied using the following logic:

If a car is assembled in the U.S.:

- If the vehicle is 85% or more North-American, no tariff is owed.4

- Otherwise, a 15% credit was applied to the non-North American slice and then 25% tariffs were applied to the remaining portion of non-North American parts. Credits are only computed for the first year.

If a car is manufactured or assembled outside North America:

- Non-North American content is tariffed based on part origin: 15% for Japan, Korea, and non-U.K. EU countries, 10% for the U.K., and 25% for all others, including any unspecified sources

To estimate tariff-driven insurance premium increases, we calculated each vehicle’s effective tariff rate, then applied industry-standard assumptions on the portion of repair costs attributed to parts and the share of insurance premiums covering vehicle damage. We then applied these percentage increases to a typical full coverage annual premium to estimate the insurance cost impact per vehicle.

MSRP data was compiled from multiple sources including Kelley Blue Book, Car and Driver, TrueCar, manufacturers websites and dealership listings. Prices are ballpark estimates of starting prices and differ based on trim levels, configurations and geography.

Using the effective tariff rate, we estimated cost impact in dollars and the revised post-tariff price for each vehicle.

In cases where identical models were manufactured in multiple locations (e.g., some Honda CR-Vs are assembled in the U.S., others in Canada), we computed the average tariff cost for each model within its manufacturer to provide a unified view.

Read the full methodology and all the updates here.

Citations

- NHTSA. “MY2024 AALA by Percent Content.” National Highway Traffic Safety Administration (NHTSA), American Automobile Labeling Act (AALA). https://www.nhtsa.gov/part-583-american-automobile-labeling-act-reports ↩︎

- U.S. Trade Representative. “Chapter 4: Rules of Origin.” USMCA Full Text. https://ustr.gov/sites/default/files/files/agreements/FTA/USMCA/Text/04-Rules-of-Origin.pdf ↩︎

- Congressional Research Service. “IF12082 – U.S. Auto Tariffs and the U.S.-Mexico-Canada Agreement.” https://www.congress.gov/crs-product/IF12082 ↩︎

- The White House.” Fact Sheet: President Donald J. Trump Incentivizes Domestic Automobile Production.” https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-incentivizes-domestic-automobile-production/ ↩︎

Sinduja Rangarajan is an award-winning journalist whose reporting has informed public understanding and driven meaningful change. Her most recent role was as a senior data reporter at Bloomberg News, where her work received multiple honors, including recognition as a Pulitzer Prize finalist for her contributions to the “water grab” series in 2024.

Before joining Bloomberg, she served as a data and interactives editor at Mother Jones and as a data reporter at Reveal from The Center for Investigative Reporting. She holds two master’s degrees in communications and journalism, as well as a bachelor’s degree in computer science. She lives in the San Francisco Bay Area with her partner and two children.

Lacie Glover is a Lead Writer and Editor with sixteen years’ experience in the insurance category. Prior to Jerry, she spent more than a decade on NerdWallet’s content team writing, editing and then overseeing the auto insurance category, as well as dabbling in other insurance and automotive topics. Prior to her career in the online personal finance content space, Lacie spent time in the hard sciences, in clinical research and chemistry labs. She has a bachelor’s degree from Colorado State University.

Annie is a writer and editor at Jerry with more than a decade of experience writing and editing digital content. Before joining Jerry, she was an assistant assigning editor at NerdWallet. Her past work has appeared in the Associated Press, USA Today and The Washington Post. Her work has been cited by Northwestern University and Harvard Kennedy School. Annie served as a spokesperson for NerdWallet during her time at NerdWallet and has been featured in New York Magazine, MarketWatch and on local television and radio stations.

Previously, she worked at USAA and newspapers in Minnesota, North Dakota, California and Texas. She has a bachelor’s degree in journalism from the University of Minnesota.