The phrase “actual cash value” in insurance refers to the worth of insured property at the time it’s damaged, lost or stolen, minus any reduction in value from factors like age and condition.

Here’s a breakdown of how actual cash value works, and the difference between what it costs to fully replace property compared to the amount a policy may pay out after a claim.

What is “actual cash value”?

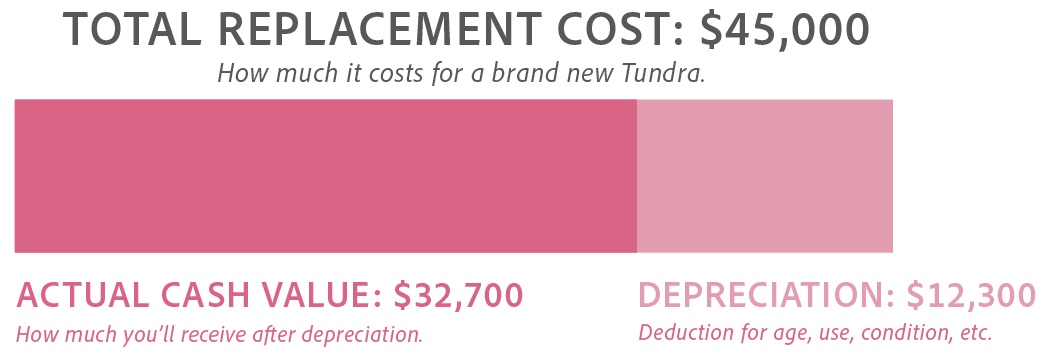

Actual cash value (ACV) is the cost to replace damaged, lost or stolen property, minus any deprecation. Here’s a formula representing how actual cash value is calculated:

Actual cash value = Replacement cost – depreciation

While some may use the term “ACV insurance,” actual cash value isn’t actually a type of car insurance. Instead, it refers to a policy that covers property on an actual cash basis.

An example of how actual cash value works in auto insurance is in a full coverage policy with comprehensive and collision coverage. If your policy includes those coverages and your car is totaled, the insurer will pay out up to the current market value — or actual cash value — of your car, minus your deductible.

Here’s a scenario of how this could work: Let’s say you have an auto policy with collision coverage for your 2023 Toyota Tundra. While it’s still in great shape, it already has 73,000 miles. You’re involved in a collision with another vehicle and the truck is totaled. You file a claim and start shopping around for a replacement and realize it’ll be about $45,000 to purchase a brand-new Tundra. Meanwhile, your insurance company pays out $32,700, which takes into account your deductible plus the totaled truck’s depreciation over the last two years, including its mileage and condition.

More: Compare cheap car insurance

How depreciation is calculated

Depreciation is generally calculated by looking at both the replacement cost value and average life expectancy of an item, vehicle or property. But each insurer has their own method for calculating depreciation, and some may even bring in third-party adjusters to investigate a claim and determine how much an insurer should pay out for it.

When determining an insured property’s actual cash value, depreciation can be calculated in a variety of ways:

- In auto insurance, depreciation can be determined by looking at a vehicle’s age, model type, condition, trim level and salvage value, among other factors.

- In home insurance, depreciation takes into account even more factors, like how old the property is, the current market value of your home, any personal belongings inside and what building materials were used.

Here’s how depreciation could be calculated for a homeowners insurance claim: Say you have a small house fire and your living room is damaged. Your five-year-old couch is a total loss and costs $4,000 to replace. Your insurance company estimates that the destroyed couch is only worth $2,500 due to its age and usage over time. While this isn’t enough to replace the destroyed couch with a brand new one, it’s the actual cash value of the couch at the time it was destroyed, accounting for its depreciation.

More: How to save money by comparing car insurance quotes

How ACV works in insurance

Understanding how ACV works is important as it determines how much you’re reimbursed if you file an insurance claim. Since ACV reimburses you only for the value of your property at the time it was damaged, you’ll likely receive a claims payout less than the amount you originally spent to purchase it.

Many insurance policies, including auto and home insurance, automatically offer coverage on an actual cash value basis, but you may be able to choose replacement cost coverage instead. Replacement cost coverage pays to replace lost or damaged property at its current price, and doesn’t account for depreciation. For example, an auto policy that includes new car replacement coverage would pay for a brand-new car of the same value if your vehicle was totaled.

More: Compare the best car insurance companies

Insurance policies that cover property on an actual cash value basis typically cost less than those with replacement cost coverage, but you’ll likely be on the hook for any out-of-pocket costs to completely replace an item, vehicle or property after a claim.

FAQs

-

How can I determine the actual cash value of my car?

-

Can I negotiate an ACV offer?

Stephanie Colestock is a professional writer, CFEI®, and licensed insurance agent specializing in personal finance. With over 14 years of experience, she crafts insightful and accessible content on a wide range of financial topics, including insurance, loans, credit/debt, investing, retirement planning, and banking.

Her bylines appear in top-tier publications such as TIME, Fortune, MSN, Business Insider, USA Today, Money, Fox Business, and CBS. Stephanie’s deep understanding of complex financial concepts and her ability to communicate them clearly have made her a trusted voice in the industry.

When she’s not writing, Stephanie enjoys SCUBA diving, reading a good book, and traveling the world with her family.

Ben Moore is a writer and editor at Jerry and an auto insurance expert. He previously worked as a writer, editor and content strategist on NerdWallet’s auto insurance team for five years. His work has been published in The Associated Press, Washington Post, Chicago Sun-Times, MarketWatch, Nasdaq and Yahoo News. He also served as a NerdWallet spokesperson, with appearances on local broadcast television and quotes in Martha Stewart and Real Simple magazine.

Ben has an extensive background in digital marketing, working on affiliate and programmatic advertising campaigns for brands like Cabela’s, H&R Block and Sears. He holds a bachelors degree in marketing from Olivet Nazarene University.